How the LMI Explains the State of Logistics

The following is an excerpt from our “State of Logistics – Q1 ’24” report regarding the Logistics Managers’ Index (LMI). To read our full “State of Logistics” report for Q1, you can download it for free here.

What is the Logistics Managers’ Index (LMI)?

One of the major news outlets that observes and reports on the health of the logistics industry is the Logistics Manager’s Index (LMI). Today, we will break down the latest LMI report that came out in February of 2024 along with key takeaways from important sectors within Logistics. But before going any further, what exactly does the LMI cover?

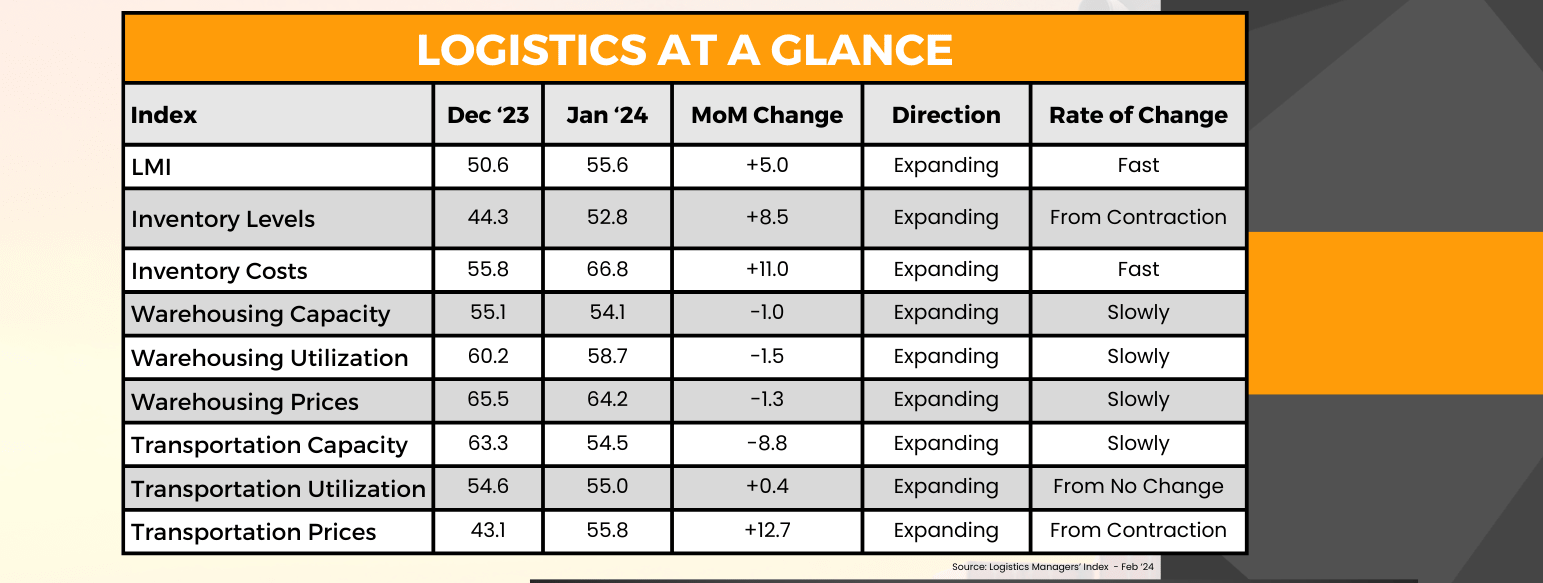

The LMI focuses on eight unique sections within Logistics: Inventory (Levels and Costs), Warehousing (Capacity, Utilization, and Prices) and Transportation (Capacity, Utilization, and Prices). Everything from headlines to growth/contraction status, to how quickly each sector is changing. Additionally, each of the sectors is given a number out of 100 that readers can use to score against itself to see trends over time. For example, Inventory Levels were a “44” in December ’23 and a “52” in January ’24. Are those numbers bad? Good? Fine? The LMI shows you historical context to form takeaways. At the end of the publication, the LMI gives the entire industry one average score out of “100.” Just like with each individual sector, this score is used against itself so that users can see growth and contraction within Logistics over time.

Now with that introduction out of the way, let’s dive into the LMI’s January edition to make some takeaways for Q1.

Current Logistics Managers’ Index (LMI) Score

The LMI score for January 2024 is “55.6.” The LMI being above “50” signals a clear recovery from the rough freight waters seen for most of 2023. The current score is far from its all-time high in 2022 but potential reveals a solid “growth number” that Logistics could sustain over the long term.

Rate of Change

Below is a look at the month-to-month conditions of our industry according to the Logistics Managers’ Index (LMI). You can see what is expanding, remaining the same, or contracting along with the rate those changes are occurring. Next, we will cover how the LMI has looked over the last twelve months.

Expanding Fast:

- Inventory Levels

- Inventory Costs

- Transportation Utilization

- Transportation Prices

Expanding Slow:

- Warehouse Capacity

- Warehouse Utilization

- Warehouse Prices

- Transportation Capacity

No Change:

- None

Contracting Slow:

- None

Contracting Fast:

- None

Takeaways For Each Sector

Warehousing Capacity: (-1.0 Change)

It’s always faster to build a truck than a large warehouse. This means that although the demand for more Warehousing capacity may be increasing, it’s significantly slower to react than other areas within Logistics. 2024 will most likely see prices and utilization remain high as capacity looks to find a way to keep up.

Score: 54.1

Warehousing Prices: (-1.3 Change)

Lack of capacity and high utilization means warehouse prices will remain high in 2024.

Score: 64.2

Warehousing Utilization: (-1.5 Change)

Average occupancy of most warehouses is going to range between 95-97% for most of 2024 which is higher than the 15-year average of 93.6%. The bigger news isn’t how much Warehousing is being used but who is using it. Large retailers don’t need as much warehouse space because they are slimming down their inventory in stores. This is a clear shift toward “just in time” inventory management in hopes that big business can increase their profit margins. The only reason warehouse utilization is going to be so high in 2024 is because of the influx of 3PLs who now need the space as they add “e-commerce” to their service offering.

Score: 58.7

Inventory Levels: (+8.5 Change)

After the 2023 holiday season and subsequent return season in January, retail giants have officially reloaded as of February. Though, in comparison, smaller companies (<1,000 employees) have lower inventory levels right now. For Logistics to enter back into a “boom” period, we will have to wait for smaller companies to reap the benefits currently experienced by larger firms. Expectations for this year are for high levels of inventory turnover and re-stocks occurring on an “as-needed” or “just-in-time” basis. More and more shippers will try to optimize their inventory through AI.

Score: 52.8

Inventory Costs: (+11.0 Change)

One of the biggest moves within the LMI right now is in Inventory costs. Inventory costs rebounded from an all-time low to now poised for growth in 2024. If inventory levels remain as high as they are projected to be, you can expect to have high inventory costs go along with that.

Score: 66.8

Transportation Capacity: (-8.8 Change)

Even though Yellow’s massive closure last year flooded the market with trucks for sale, transportation capacity remains “tight” for everyone in the Supply Chain. Capacity fell off a “cliff” in December with the holiday season and hasn’t quite recovered yet. The good news? Transportation capacity will be on a steady incline throughout 2024.

Score: 54.5

Transportation Prices: (+12.7 Change)

Diesel has had a hard time dipping below $4 a gallon over the last two years. It’s happened twice with one of those times coming this past January at $3.80 a gallon. For the short term, we know that shippers have a high demand to move freight in Q1 reloading from the holidays. We also know that the shift toward “just in time” inventory should maintain the need to move freight throughout the rest of the year. Even if diesel dips below $4, the demand is going to remain constant throughout 2024 driving prices up regardless.

Score: 55.8

Transportation Utilization: (+0.4 Change)

Transportation utilization slowed down significantly after the holiday season, but after the reload from shippers, utilization is back on track. Overall, utilization is poised for steady growth in 2024.

Score: 55

LMI Conclusion

Even when certain sectors within the LMI might be in temporary “contraction” the long-term outlook for the industry as a whole seems very positive for 2024.

—

Want to read more about the current and future “State of Logistics?”

Download Top Talent’s “State of Logistics – Q1 ’24” Report for free here. It includes quotes from industry leaders about what they are seeing so far in Q1, five market conditions affecting Logistics, interpretations from FreightWaves, and even how you can hire better given the talent landscape for 2024. Don’t miss out!